The exam’s Comprehension Text

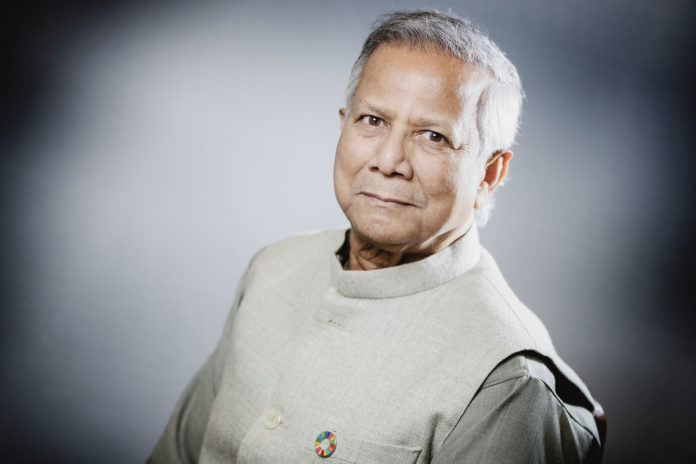

Professor Muhammad Yunus, a Bangladeshi banker and economist, is the

inventor of the idea of microcredit. It consists in giving out small loans to people who

are too poor to obtain credit from ordinary banks. His revolutionary Grameen Bank,

which is based on principles of trust and solidarity, helps needy people to start small

businesses and move out of poverty.

Mr Yunus, who is often referred to as the banker to the poor, came up with the

idea in 1976 while teaching economics at Chittagong University, in southern

Bangladesh. He found out that lending small amounts of money to the women who

were making furniture in a nearby village could make a difference in their life. He lent

$ 27 from his own pocket to 42 women who used to borrow money from local lenders

who asked for high interest rates. Thus, microcredit was born, and so was Grameen

Bank. Until now, it has lent $ 6.38 billion to 7.4 million of the poor in the world, most

of them in Bangladesh. According to Mr Yunus, the majority of the beneficiaries are

women since they not only use the money they get from the bank better than their

husbands, but they are also careful about paying it back.

The professor’s idea is to help the poor to help themselves: ‘give a man a fish and you feed him for a day, teach him how to fish and he feeds himself for life.’ So he never gives charity to a blind person, a disabled beggar or a mother holding her baby. Yunus told journalists in an interview at Grameen Bank: “I prefer to solve their problems for the rest of their life and not just take care of them for one day.”

To guarantee repayment, the bank uses a system of solidarity groups. To be selected for a loan, the borrowers have to form a group to support each other in repaying. If one group member fails to pay back his debt, the others are also responsible. Even beggars have benefited from this programme. They have been given small loans to start out as street vendors to help them give up begging.

The success of Grameen Bank has encouraged many developing countries, and even industrialised ones, to adopt this model. Banks similar to Grameen Bank have been operating in many countries including France, Canada and the US, where microcredit has been introduced to some of the poorest communities in Arkansas.

Professor Yunus has managed to solve financial and social problems of millions of poor people. His work, therefore, has been internationally recognised. In 2006, he received the Nobel Prize for his efforts to create economic and social development for people from the lowest level of society. The Norwegian Nobel Prize Committee said that by giving the award to Mr Yunus, they wanted to encourage the fight against poverty as well as the need to empower women.

National exam | Arts Stream | Ordinary Session 2010 with Answers